work opportunity tax credit questionnaire reddit

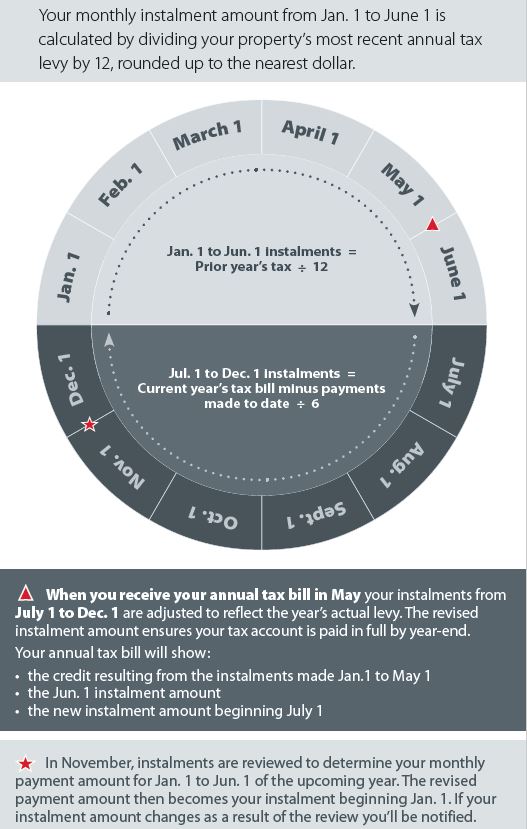

If you belong to a WOTC target group your employer will get a tax credit from the government. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US.

Wotc Wednesday How Do I Explain Why We Are Asking If The Employee Has Received Snap Food Stamps Cost Management Services Work Opportunity Tax Credits Experts

The employee groups are those that have had significant barriers to employment.

. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Felons at risk youth seniors etc.

Ago Its not uncommon. You and the applicant need to complete IRS Form 8850 which is the IRS pre-screening. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

This tax credit program has been extended until December 31 2025. Some companies get tax credits for hiring people that others wouldnt. Call 800-517-9099 or click here to use our contact form to ask any questions.

Work opportunity tax credit questionnaire employers receive substantial tax credits for hiring certain applicants under the work opportunity tax credit or. Updated on September 14 2021. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment.

The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. I just applied for a job with a well known beauty retailer about an hour ago. This tax credit is for a period of six months but it can be for up to 40.

Qualified short-term and long-term IV-A recipients Temporary Assistance for Needy Families. As part of the application process we ask that you complete a short questionnaire in order to assess eligibility for the Work Opportunity Tax Credit Program WOTC. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment.

It asks for your SSN and if you are under 40. Below you will find the steps to complete the WOTC both ways. This is a real thing meant to encourage businesses to hire people from groups that historically have trouble finding employment.

It also says that the employer is encouraged to hire individuals who are facing barriers to employment. Español WOTC Improve Your Chances of Being Hired The Work Opportunity Tax Credit WOTC can help you get a job If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers.

New hires may be asked to complete the WOTC questionnaire as part of their onboarding paperwork or even as part of the employment application in some cases. Contact CMS Today to Start Saving. Suppose I should explain why the want you to fill one out.

Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. Are employees required to fill out WOTC form. The federal government uses the tax credits to incentivize employers to hire from specific groups of people that are seeing high unemployment numbers.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The following groups are considered target groups under the WOTC program. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire people in certain target demographics who often experience employment barriers.

Level 1 1 yr. 2 level 1 icebattler 4y I dont think there are any draw backs and Im pretty sure its 100 optional 1. Its called WOTC work opportunity tax credits.

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. Ive never been asked to fill out a. About 10 minutes after I submitted my application the company sent me a Work Opportunity Tax Credit form to fill out and is asking for my SSN.

The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. First the employee will complete the tax credit questionnaire as an application task.

The answers are not supposed to give preference to applicants. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. The data is only used if you are hired.

This tax credit may give the employer the incentive to hire you for the job. If youre interested in taking advantage of the WOTC its important to know. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits.

Employers can claim tax credits each year for each employee they hire in this demographic. Make sure this is a legitimate company before just giving out your SSN though. Contact CMS today to start taking advantage.

By creating economic opportunities this program also helps lessen the burden on other government assistance programs. A company hiring these seasonal workers receives a tax credit of 1200 per worker. The first step to obtaining the Work Opportunity Tax Credit is figuring out if the worker you hired qualifies.

It is legal and you can google it. WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment. In over 20 years of providing valuable WOTC Screening and Administration services weve saved millions for our customers.

In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. Employers may meet their business needs and claim a tax credit if they.

I was under the impression that employers were not allowed to ask about age because it is a slippery slope to discriminating on the basis of age. Wotc work opportunity tax credit questionnaire ks staffing solutions inc. That is why before the employee begins to work for your business you need to have them fill out two forms and follow these steps.

Irs Highlights Info About The Credit For Other Dependents Taxing Subjects

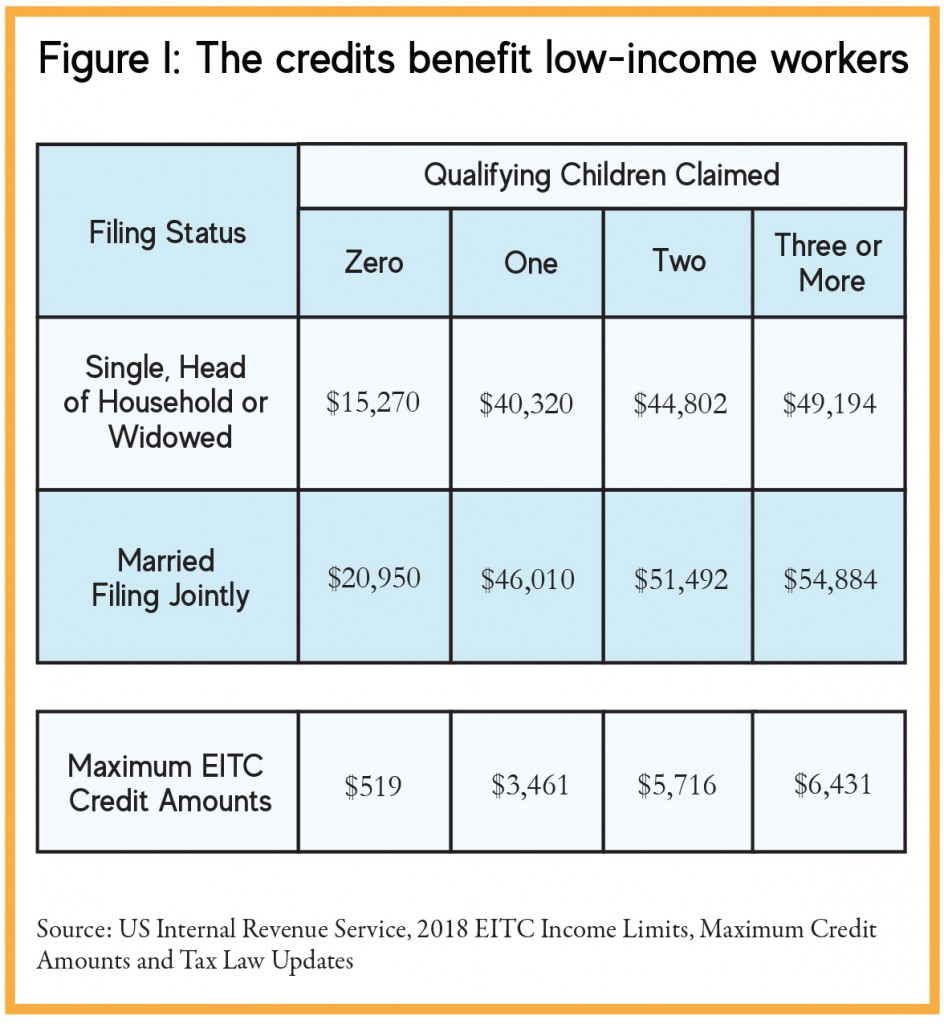

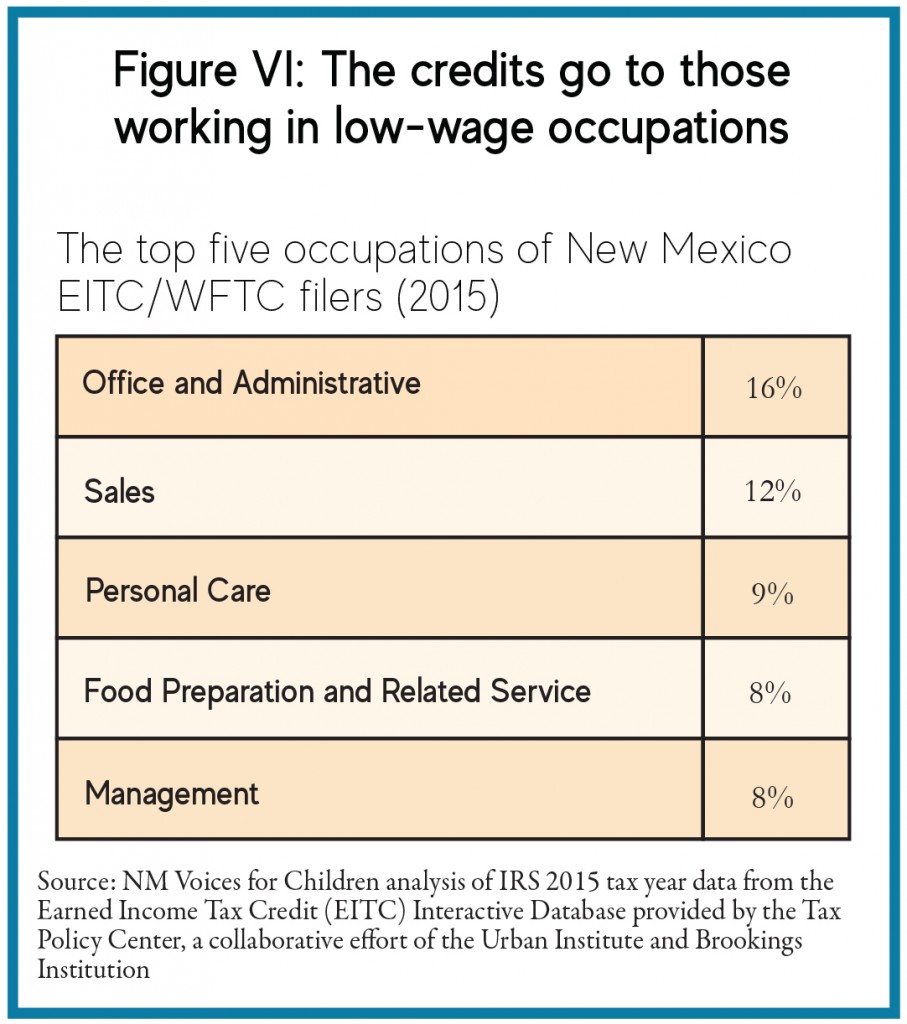

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Tips To Stay Happy Always Tips Infographics Pinterest Infographics And Infographic

Wotc Questions Where Do I Get A Copy Of A Dd214 Form Cost Management Services Work Opportunity Tax Credits Experts

Job Title Of Drivers Media Assistant R Formula1

Wotc Wednesday How Do I Explain Why We Are Asking If The Employee Has Received Snap Food Stamps Cost Management Services Work Opportunity Tax Credits Experts

Contact Us 1 800 517 9099 Cost Management Services Work Opportunity Tax Credits Experts

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Contact Us 1 800 517 9099 Cost Management Services Work Opportunity Tax Credits Experts

Empowerment Zones Enterprise Zones Rural Renewal Counties Map Cost Management Services Work Opportunity Tax Credits Experts

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library